Introduction to Nykaa Share Price

Nykaa, a leading name in the beauty and wellness industry, has made significant strides since its inception. With its initial public offering (IPO) making waves in the stock market, many investors have their eyes on Nykaa share price. This article delves into the current trends, factors affecting the share price, and future prospects for Nykaa’s stock.

Understanding Nykaa’s Market Position

- Nykaa has established itself as a dominant player in the e-commerce space, particularly in the beauty and personal care segment. This strong market position has contributed to its robust financial performance, which in turn impacts the share price. As the company continues to expand its product offerings and market reach, its share price reflects its growing influence and market capitalization.

- Factors Influencing Nykaa Share Price

- Company Performance: The share price of Nykaa is heavily influenced by the company’s quarterly earnings reports, revenue growth, and profitability metrics. Positive financial performance often leads to an increase in the share price, while missed targets can result in a decline.

- Market Sentiment: Investor sentiment plays a crucial role in determining share price movements. Positive news about the company, such as successful product launches or strategic partnerships, can boost investor confidence and drive up the share price.

- Industry Trends: Nykaa operates in a highly competitive market, and industry trends significantly impact its share price. For instance, increased demand for e-commerce and digital beauty solutions has positively influenced Nykaa’s valuation.

- Economic Factors: Broader economic conditions, such as interest rates, inflation, and consumer spending habits, also affect Nykaa’s share price. In a strong economy, consumer spending typically increases, benefiting companies like Nykaa.

- Regulatory Environment: Changes in regulations related to e-commerce, taxation, and data privacy can impact Nykaa’s operations and, consequently, its share price. Investors closely monitor regulatory changes to gauge their potential effects on the company.

Recent Trends in Nykaa Share Price

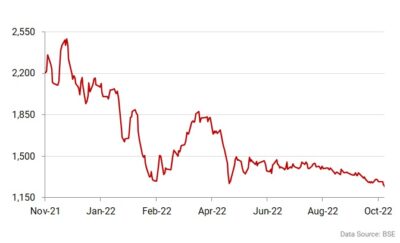

Nykaa share price has experienced volatility since its IPO, with fluctuations driven by market dynamics and company-specific developments. Recently, the stock has seen a steady rise, attributed to strong quarterly earnings and positive market sentiment. Investors have shown confidence in Nykaa’s growth strategy, leading to increased demand for its shares.

Technical Analysis of Nykaa Share Price

Technical analysis involves studying historical price movements and trading volumes to forecast future price trends. Key indicators such as moving averages, relative strength index (RSI), and Bollinger Bands are commonly used to assess Nykaa’s stock performance.

- Moving Averages: Nykaa’s share price moving averages, such as the 50-day and 200-day moving averages, provide insights into the stock’s trend direction. A bullish crossover, where the short-term average moves above the long-term average, indicates potential upward momentum.

- RSI (Relative Strength Index): The RSI measures the speed and change of price movements, helping investors identify overbought or oversold conditions. Nykaa’s RSI can signal whether the stock is due for a correction or a breakout.

- Bollinger Bands: Bollinger Bands help investors visualize price volatility. Nykaa’s share price nearing the upper band may suggest overvaluation, while a move towards the lower band could indicate undervaluation.

Fundamental Analysis of Nykaa Share Price

Fundamental analysis evaluates a company’s financial health, market position, and growth potential. For Nykaa, key factors include revenue growth, profit margins, and market share expansion. Investors also consider the company’s ability to innovate and adapt to market changes.

- Revenue Growth:

- Nykaa’s consistent revenue growth is a positive sign for investors. The company’s ability to attract and retain customers through a diverse product range and effective marketing strategies has contributed to its financial success.

- Profit Margins:

- Analyzing Nykaa’s profit margins helps investors understand the company’s cost management and pricing power. Strong margins indicate efficient operations and a competitive edge in the market.

- Market Share Expansion:

- Nykaa’s efforts to expand its market share, both domestically and internationally, are crucial for long-term growth. The company’s strategic initiatives, such as entering new categories or geographic markets, are key drivers of future share price appreciation.

Future Prospects for Nykaa Share Price

Nykaa’s future prospects are promising, given its strong market position, innovative approach, and expansion plans. The company’s focus on enhancing customer experience, leveraging technology, and diversifying its product portfolio is likely to drive sustained growth.

- Expansion into New Markets:

- Nykaa’s plans to enter new markets, including international expansion, present significant growth opportunities. This strategic move could result in increased revenues and a higher share price.

- Technological Advancements:

- Nykaa’s investment in technology, such as artificial intelligence and data analytics, enhances its operational efficiency and customer engagement. These advancements are expected to contribute positively to the company’s financial performance.

- Strategic Partnerships:

- Collaborations with global brands and strategic partnerships can boost Nykaa’s market presence and product offerings, further supporting share price growth.

- Sustainability Initiatives:

- Nykaa’s commitment to sustainability and eco-friendly products aligns with growing consumer preferences for ethical brands. This focus on sustainability may attract socially conscious investors, positively influencing the share price.

Conclusion

Nykaa share price is shaped by a combination of company performance, market dynamics, and broader economic factors. With a strong market position and growth-oriented strategy, Nykaa remains an attractive investment option. As the company continues to innovate and expand, its share price is expected to reflect its long-term potential.

FAQs

1. What are the key factors influencing Nykaa’s share price?

Nykaa’s share price is influenced by company performance, market sentiment, industry trends, economic factors, and regulatory changes.

2. How does Nykaa’s financial performance impact its share price?

Positive financial performance, such as revenue growth and profitability, typically leads to an increase in Nykaa’s share price.

3. What is the significance of technical analysis for Nykaa’s share price?

Technical analysis helps investors predict future price movements using historical data and indicators like moving averages and RSI.

4. What are Nykaa’s future growth prospects?

Nykaa’s growth prospects include market expansion, technological advancements, strategic partnerships, and sustainability initiatives.

5. How does market sentiment affect Nykaa’s share price?

Positive market sentiment, driven by good news or strong financial performance, can increase investor confidence and push up Nykaa share price.

for more blog like this visit our site Businessninza